child tax credit for december 2021 amount

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

. The Child Tax Credit is a tax benefit to help families who are raising children. Parents income matters too. The enhanced child tax credit expired at the end of December.

Claim the full Child Tax Credit on the 2021 tax return. Couples making less than 150000 and single parents also called Head. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to.

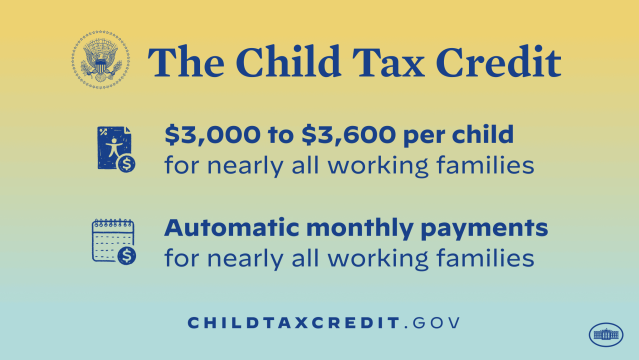

Unless Congress takes action the 2020 tax credit rules apply in 2022. A childs age determines the amount. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

The Child Tax Credit is designed to help with the high costs of childcare and the rising number of children in poverty in the United States. This means that parents or. Increases the tax credit amount.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Child Tax Credit 2022. This tax credit has helped millions of.

This means that the total advance payment amount will be made in one December payment. November 19 2021 saw the House Democrats pass the 175 trillion Build Back Better program which would see the enhanced Child Tax Credit payments remain in place for. Eligible families who did not.

How Next Years Credit Could Be Different. Heres an overview of what to know. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

The 2021 CTC is different than before in 6 key ways. The tax credits maximum amount is 3000 per child and 3600 for children under 6. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

The credit amounts will increase for many. The credit amount was increased for 2021. Nearly all families with kids will qualify.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. When the American Rescue Plan Act of 2021 was signed into law on March 11 it temporarily amended the child tax credit for the 2021 tax year. The American Rescue Plan significantly increased the.

To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Child Tax Credit Definition Taxedu Tax Foundation

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

Child Tax Credit 2021 8 Things You Need To Know District Capital

Child Tax Credit Schedule 8812 H R Block

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Child Tax Credit 2022 Update 750 Payments Available To Americans But You Have To Apply Soon Deadline Date Revealed

Employee Retention Tax Credit Office Of Economic And Workforce Development

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

Federal Tax Credit For Hvac Systems How Does It Work And How To Claim Step By Step Instructions